India’s start-up narrative remains strong and optimistic.

The country has become the third largest1 ecosystem globally with more than 1,12,000 start-ups in existence as on October 3, 2023. A key contributor to this success has been the PE-VC markets, which have risked capital and sown financial knowhow.

Geographical penetration has deepened as well. PE-VC deal activities have gone beyond Tier 1 cities, deals in these cities have surged ~220x in a decade — from Rs 318 million in fiscal 2013 to Rs 71 billion in fiscal 2023.

Technology has been at the core of investments in the PE and VC markets in India, transforming the sectoral distributions in the past 10 years.

The growth of the private equity markets has also been funnelled by the rising popularity of AIFs. They have become an integral part of the domestic PE-VC market and a vital source of capital to startups. This segment has picked up pace in the past five years, with two-thirds of the 1,096 AIFs registered as on March 31, 2023, having been registered during this period.

CRISIL’s analysis of 217 funds belonging to vintages FY13 to FY22 shows that Indian private markets (category I venture capital funds and category II equity funds investing in unlisted securities combined) outperformed a public market equivalent (using S&P BSE Sensex TRI) by 13.5% (as of March 2023). The result is not driven by a few superstars. A majority of the funds in the sample had internal rate of returns (IRRs) above the public market equivalent.

Commitments have risen at an annualised 38%2 in the past five years to Rs 8.34 trillion as of March 2023.

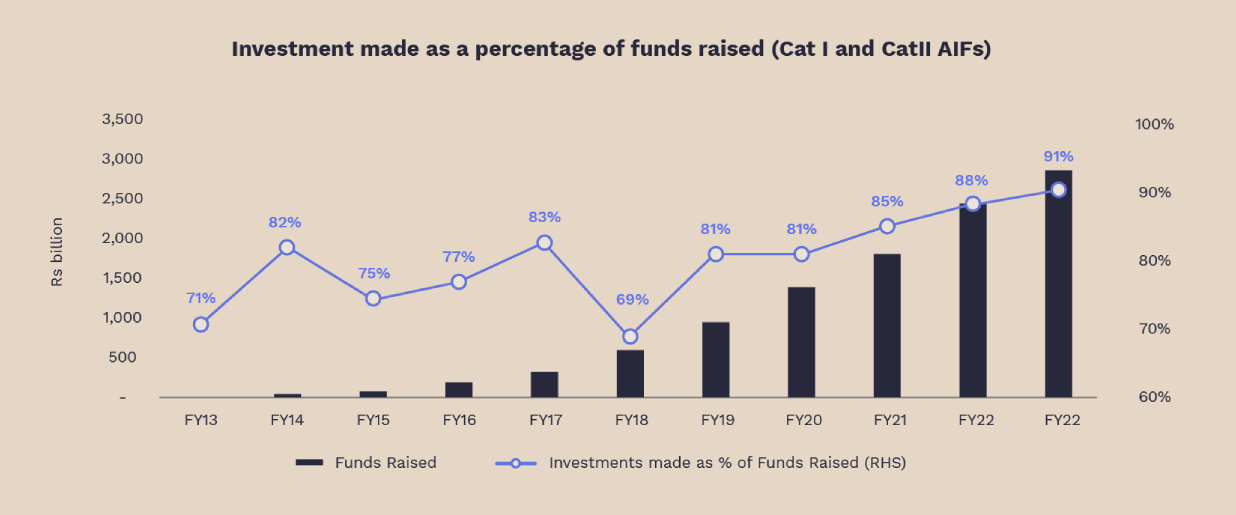

To be sure, the unlisted markets have expanded, as reflected in significant reduction in deployment time indicated by the increase in investments made to funds raised for Category I and II AIFs in the past five years ended March 2023.

The segment has also emerged as an attractive investment destination for high-net worth individuals (HNIs) and ultra-high net worth individuals (UHNIs) as they seek out differentiated products that give them an option to generate better returns on their investments. Notably, as of March 2023, over 40 investment managers manage at least three AIF schemes.

Despite the global headwinds, India remains an attractive destination for PE and VC investments in the long term. Robust economic growth, rising entrepreneurship, a largeconsumer base, higher adoption rate of digitalisation, a favourable regulatory environment, and government initiatives and schemes should provide ample opportunities for investors in coming years.

Substantial alpha generated by aggregate AIF benchmarks in the private market compared with the PME+ despite downturn in returns has been a big plus for the segment. As of March 2023, the aggregate benchmark3 was able to generate an alpha4 of 13.5% over the public market index (S&P BSE Sensex TRI).

This performance is not driven by a few funds — distribution of alpha recorded by funds in the benchmark over their respective public market equivalent reveals that more than 75% of the funds have generated positive alpha.

Robust economic growth, rising entrepreneurship, a large consumer base, higher adoption rate of digitalisation, a favourable regulatory environment and government initiatives should provide opportunities for the AIF segment to grow in the coming years.

Entry of domestic institutional investors, such as retirement funds and insurance companies, in this space, increasing investment opportunities beyond Tier 1 cities and supply surplus from the booming startup culture in the country will further boost AIF growth.

The quality of the private market opportunities in India has improved along with its growth. There are now forty-plus fund managers who have raised three or more funds, an indication of both depth of experience and consistent performance. The evolution of the deep tech ecosystem indicates increasing sophistication. Regulatory oversight of the market provides increasing transparency and protection for investors.

The growth of the private markets in India is part of a global trend — that of expansion of private markets outside the USA and Europe. Within this larger trend, India is in an advantageous position due to government policies that provide a solid platform for commercial innovation, from the GST to the India Digital Stack to expansion of roads and airports. This innovation-rich environment is India’s unique advantage and may explain why in India alone venture capital has been the largest part of the private market for some time. This environment is getting support from emerging pools of domestic capital, whether from the state, corporates, entrepreneurs, or family offices, and is expected to only grow from here.

That said, after seeing robust growth in the past few years, PE-VC funding fell ~67% last fiscal as global macro headwinds intensified. The relatively young AIF industry will also need to go through the test of time as fund managers will be scrutinised for their ability to make timely exits at favourable valuations.

This, in turn, will establish the investor experience with the product, and determine their readiness for future investments in the segment.

With over 25 years of experience, Rohit Bhayana is a respected entrepreneur, private markets expert, and startup mentor. As Oister's Co-Founder, he drives the mission to strengthen Indian Alternatives by investing in top-tier VC/PE funds, catalyzing India's economic growth.

Sandeep Sinha, a seasoned entrepreneur and investor with 25+ years of hands-on experience, leverages his deep understanding of private markets. His expertise in venture capital and venture debt played a crucial role in founding Oister Global, powering India's Alternatives through investments in top-tier PE/VC funds.

CRISIL is a leading, agile and innovative global analytics company driven by its mission of making markets function better. It is India’s foremost provider of ratings, data, research, analytics and solutions with a strong track record of growth, culture of innovation, and global footprint.

It has delivered independent opinions, actionable insights, and efficient solutions to over 100,000 customers through businesses that operate from India, the US, the UK, Argentina, Poland, China, Hong Kong, UAE and Singapore.

It is majority owned by S&P Global Inc, a leading provider of transparent and independent ratings, benchmarks, analytics and data to the capital and commodity markets worldwide.

Oister endeavours to invest in a curated selection of top-tier alternative funds in India.

In the dynamic and complex world of alternative markets, Oister's curated, institutional-grade diligence-driven approach helps them understand the significant performance disparity between the best and the rest, and their dedication remains steadfast: to bring the finest opportunities through their network.

Oister identifies top-tier alternative funds through its network and strong evaluation process and carries out investments for its fund investors, which may otherwise have remained out of their reach.

At the heart of Oister is its dedicated team. With 110+ years of experience managing alternative investments, they actively navigate the intricacies of the relevant markets. Their method is thorough, identifying and collaborating with only the most reputable and successful fund managers.

Important information

The information on the website of Oister Global is for informational purposes for creating awareness about private markets as a financial product and is not meant for sales, promotion or solicitation of business or investment.

Content on this website may be taken from sources that are believed to be reliable (but may not necessarily have been independently verified), and such information should not be relied upon while making investment decisions. The content herein does not take into account individual investor’s objectives, risk appetite or financial needs or circumstances or the suitability of the products. Hence, investors are advised to consult their professional investment adviser/ consultant/ tax advisor for investment advice in this regard.

An investor should, before making any investment decision, seek appropriate professional advice.